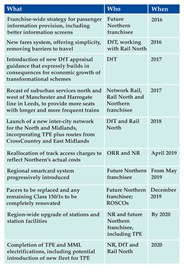

Such an approach would also help with planning progressive, small-scale improvements such as better journey times between the East Midlands and Yorkshire and the North West.

As a welcome step forwards, DfT has already indicated that the Northern franchise will be managed by a team based in the North, rather than in London. This team will therefore be in a position to interact more closely with stakeholders than is the case today.

Northern franchise subsidy

The widely held belief that Northern Rail is the most heavily subsidised franchise is based on shaky calculations and assumptions.

The allocation of track costs between differing train operators has been shown to disadvantage the local train operator across the Northern rail network. There is also a mismatch between access charges and the amounts actually being spent on the regional networks.

This means that the Northern Rail franchise is actually cross-subsidising other train operations, including those in the South. For example, the high level measure of subsidy allocation takes no account of important factors of cost causation, such as:

- The length of trains (Northern’s train is typically two-car or four-car in length, whereas inter-city train lengths vary between four and 11 cars, mostly towards the upper end of this range).

- The quality of access provided (fast, heavy trains are effectively charged the same as light trains).

- The attractiveness of the track slots provided - in Manchester, for example, priority has been given to slotting the Pendolino service through to Piccadilly, leading to a number of changes being made to timetables locally (including a reduction in ‘cross-Manchester’ services). Yet the Northern and the West Coast train are effectively charged the same rate per train-mile.

A review of the Northern franchise, commissioned when it was let in 2006, showed that the franchise was very efficient in terms of the way its staff and train fleet were used. Its relatively high subsidy is simply a direct consequence of the large geographic area it serves, the complex nature of its network (with no single ‘hub’ network to operate), and the fact that, with shorter trains, its revenue per train is lower than the national average.

Given also that the higher earning intercity (TransPennine Express) network in the North was separated out when the franchise was created a decade ago, it should not be a surprise that Northern’s subsidy is substantial.

Big picture on economic growth

The current approach to appraisal does not acknowledge the wider Government policy agenda of national north-south rebalancing.

While some attempts have been made to assess the GVA/employment impacts of major transport investment, the stepping stone developments and investments needed for the Northern franchise (when added together) will bring an appreciable contribution to wider strategic economic aims, particularly rebalancing the economy.

In the meantime, it is also important to be clear that the work done for the Northern Way and the Northern Hub project indicates that capacity improvements can be justified using the Department’s current guidance. Enhancements of this type help to increase the labour market pool available to employers in the northern city centres in a number of ways:

- Capacity to reduce peak period overcrowding constraints on specific trains and at stations can support the densification of jobs and residences in city centre areas.

- Improved connectivity via new linkages and/or reduced journey times can extend labour markets and open up access to job opportunities.

- Modern rolling stock can offer a better alternative and journey reliability to car commuters, also reducing road congestion.

- More attractive fares, such as ‘early bird’ commuter fares, can make access to remoter job opportunities more affordable.

Franchise needs to be funded

The simple truth is that in the decade to 2012/13, the total number of passengers increased by 150% into Leeds and Huddersfield, almost doubled into Bolton and Sheffield, and increased by 60% into Newcastle (compared with national growth of around 50%). The consequence has been significant overcrowding. Looking ahead, there is evidence to suggest that the rate of growth in rail commuting will be about 50% faster than total employment growth in city centres - this reflects people’s preference for rail travel over car use, which is increasingly affected by congestion and the cost and accessibility of car parking.

The net effect is that even a small increase in employment levels will translate into a significant impact on rail demand.

There is also clear evidence of suppressed rail demand in the North. When the new Class 185s were introduced on TransPennine Express (TPE) services in 2006, they added around a third to capacity. But by as early as 2008, TPE began lobbying DfT for extra carriages owing to passenger take-up of the extra capacity, resulting in overcrowding. A Passenger Focus survey identified high levels of passenger satisfaction with the investment in new modern and reliable trains, but passenger concerns on overcrowding re-appeared as quickly as May 2007.

All the evidence suggests that demand for rail is set to grow significantly across the North, and the Chancellor’s Autumn Statement indicated that subject to business case development, the new Northern and TransPennine franchises would deliver at least a 20% increase in capacity.

However, while that is welcome, the evidence about demand and the experience of introducing extra capacity in the North in the past suggests that demand growth will rapidly eat up such a capacity increase. The question of further timely additions to rolling stock capacity, in support of northern economic growth, therefore needs to be addressed.

Modernising rolling stock

Most of the existing Northern fleet of about 800 vehicles needs to be either refurbished or replaced by retro fitting traction equipment or diesel engines that offer reduced carbon emissions. Most (87%) of the trains are diesel and the average age is over 24 years, with few under 20 years old.

The most common type is the Pacer railbus that does not comply with European standards for accessible trains, and which under domestic law requires adaptation or replacement by 2020 at the latest. Northern also operates a large fleet of Sprinters that also do not meet accessibility standards. And only some of the fleet has customer information systems.

This combination of aged and poor-quality rolling stock is a peculiarly northern issue, which along with the capacity challenge has an impact on public satisfaction and the credibility of rail’s role in supporting the growth of the North’s cities and expanding labour markets.

The Northern franchise will most likely start with a small fleet of cascaded electric trains for the North West scheme, but this fleet will need to grow as further routes are electrified. The franchise should be let with resources for refurbishment of cascaded electrics and existing diesels, to ensure that the passenger experience is up to date and (ideally) matches the level provided by the Class 185 units used by TPE.

Experience with both Class 313s and HSTs has shown that older trains can be brought up to a high standard of passenger experience. The work that is being done on the Class 319s prior to transfer to Northern will hopefully also demonstrate this.

The rolling stock plan for the new franchise therefore needs to address the pressing current and future needs for additional capacity, refurbishment options and the approach to Pacer replacement.

Inter-city network

Development and promotion of a clear ‘Express Network for the North’, as called for in Rail North’s Long Term Rail Strategy, would help convince the market that rail is a good option for interurban travel right across the North, rather than just on a few corridors.

This would generate extra revenue, and build on the success that the current TPE franchise has had in growing volumes by using modern trains and marketing approaches.

Key elements already exist in the TPE and CrossCountry networks, but a number of links should be added - for example, the Calder Valley route better linking Blackpool/Preston/Blackburn/Rochdale with Bradford/Leeds/York/Scarborough; and Nottingham/Sheffield with Leeds and Manchester.